The short answer is, I don't know. Nobody knows. The reason for that is, we don't have enough data on the particular exposures we need to measure to answer that question.

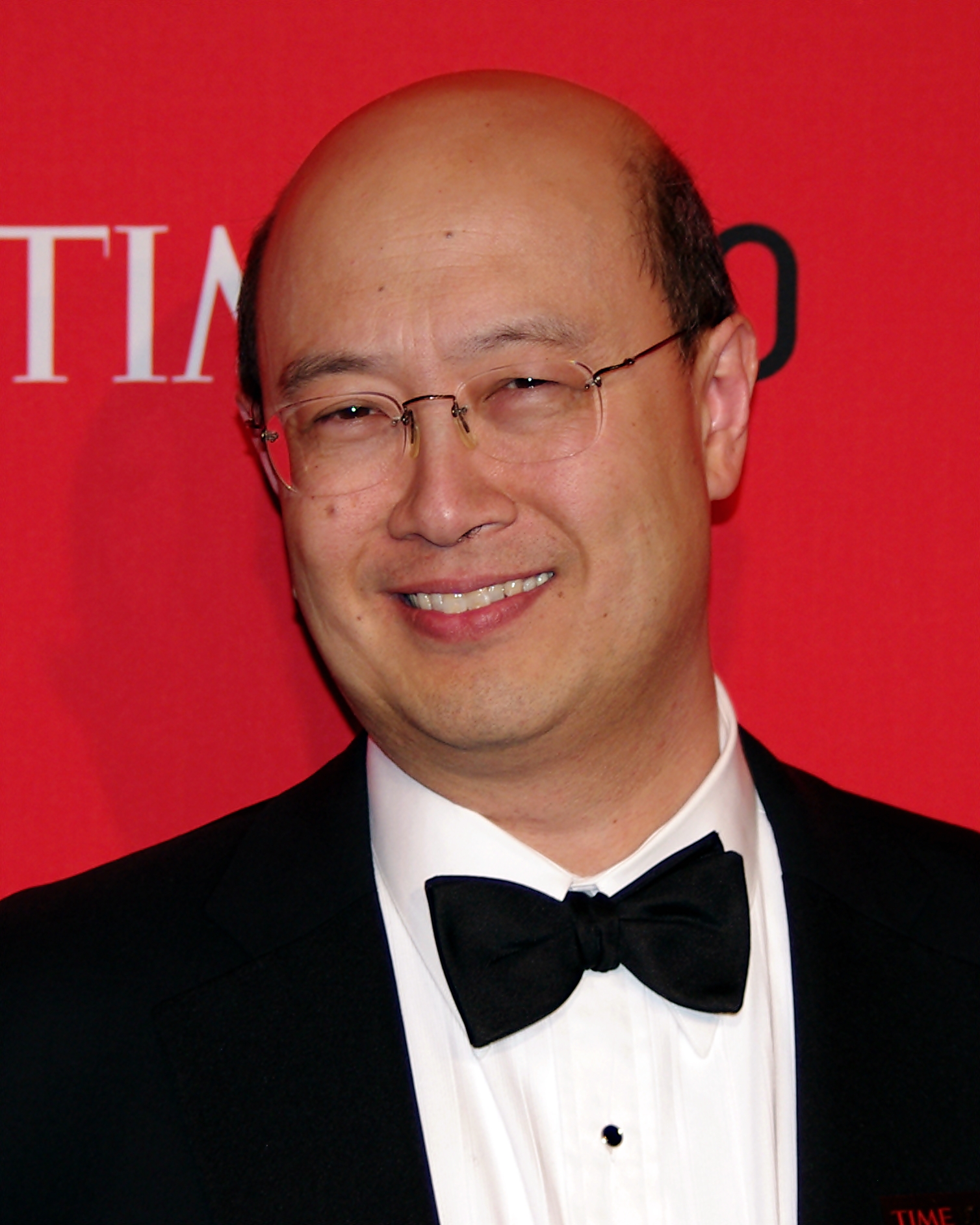

"Andrew Wen-Chuan Lo" is the Charles E. and Susan T. Harris Professor of Finance at the MIT Sloan School of Management. He is a leading authority on hedge funds and financial engineering; he proposed the adaptive market hypothesis. Lo is the author of several academic articles in Finance and Financial economics.

More Andrew Lo on Wikipedia.Just because we didn't see an event (after GM and Ford) is small comfort. There are large exposures out there we haven't seen yet. I'd say the jury is still out on whether the industry can withstand the shocks that may come out over the next few months.

Credit derivatives and hedge funds have grown fairly spectacularly over the last five years.

The fact that hedge funds have become so important is really the flip side of problems that could be generated. If they ceased to function in the way they are designed, that would create a fair amount of systemic risk.

Finance and economic research has hit a wall. We can't answer any more questions by running another regression analysis. Now, we need to get inside the brain to understand why people make decisions.

Copyright © 2024 Electric Goat Media. All Rights Reserved.