Weakness in the capital markets, compounded by an erosion of corporate and investor confidence, has depressed activity in a number of our most important businesses, ... While we have seen some encouraging economic data of late, the current environment remains very challenging.

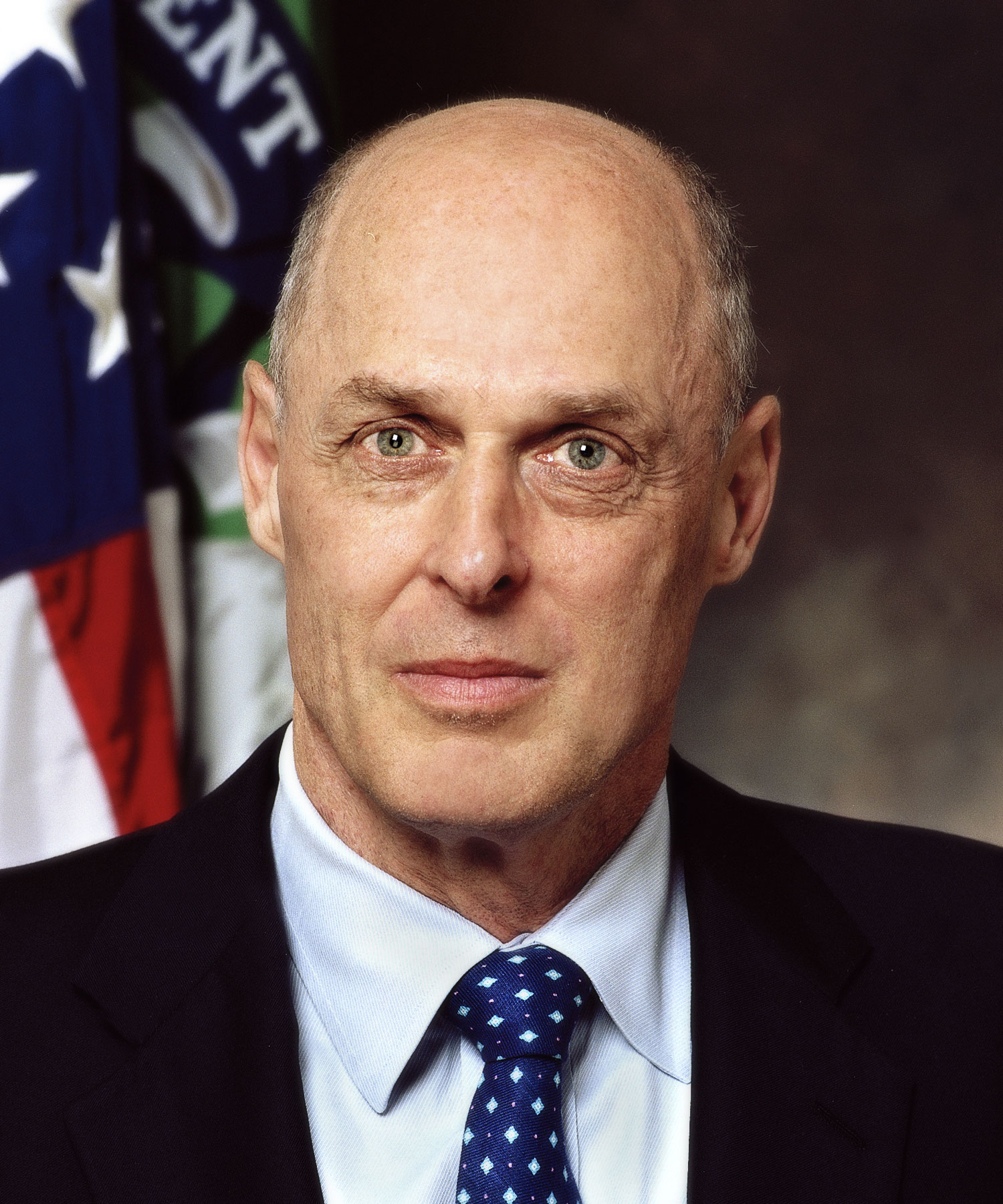

"Henry Merritt" ""Hank"" "Paulson, Jr." is an American banker who served as the 74th United States Secretary of the Treasury. He had served as the Chairman and Chief Executive Officer of Goldman Sachs, and is now chairman of the Paulson Institute, which he founded in 2011 to promote sustainable economic growth and a cleaner environment around the world, with an initial focus on the United States and China.

More Henry Paulson on Wikipedia.We are very confident about the long-term outlook for our business, but believe that the immediate impact will be a further weakening in the operating environment and a delay in the economic recovery, ... However, given increased fiscal and monetary stimulus, we anticipate that long-term economic recovery should be more certain and vigorous than previously expected.

We are taking this step to secure permanent capital to grow; to share ownership broadly among our employees now and through future compensation; and to permit us to use publicly traded securities to finance strategic acquisitions that we may elect to make in the future.

During the third quarter, we saw increasing activity levels across all of our major businesses and believe overall market conditions support a generally optimistic outlook.

This acquisition highlights Goldman Sachs' strategy of expanding our electronic market-making capabilities.

I think all of us know that what we went through in the last half of the Nineties is not sustainable. We're going to need to adjust ourselves to a period of more normal growth. How we think about managing our businesses in that environment is the tricky question we're all grappling with.

We don't have a lot more time to deal with climate change, ... We need the right balance between regulation and market-based approaches.

The best time for transition is during a period of great strength, ... We believe these appointments and the evolution of the governance of the firm will strengthen our management focus and keep the firm on a solid foundation to serve our clients, develop our people, and execute our strategy.

Today we affirm our commitment to lower Manhattan and the City of the New York, the financial capital of the world.

Copyright © 2024 Electric Goat Media. All Rights Reserved.